The Congressional Budget Office (CBO) has warned that Republicans won’t meet their budget targets without cutting Medicare and Medicaid. These programs, which provide essential healthcare to millions of Americans, would be the primary targets for spending reductions if Republicans remain focused on balancing the budget.

Medicare and Medicaid are vital programs—Medicare serves seniors, and Medicaid covers low-income individuals. Together, they represent a large portion of the federal budget. The CBO’s estimate makes it clear that without addressing these programs, Republicans won’t achieve their goal of reducing the deficit. But the premise of a “balanced budget” is flawed.

The government is not a household or business that must balance its income and expenses. It is a service, tasked with meeting the needs of its citizens, not operating with the same financial constraints. The idea that the government must balance its budget ignores the reality of a functioning economy. Unlike businesses, which aim for profit, the government’s purpose is to ensure the public good, including providing essential services like healthcare, education, and infrastructure.

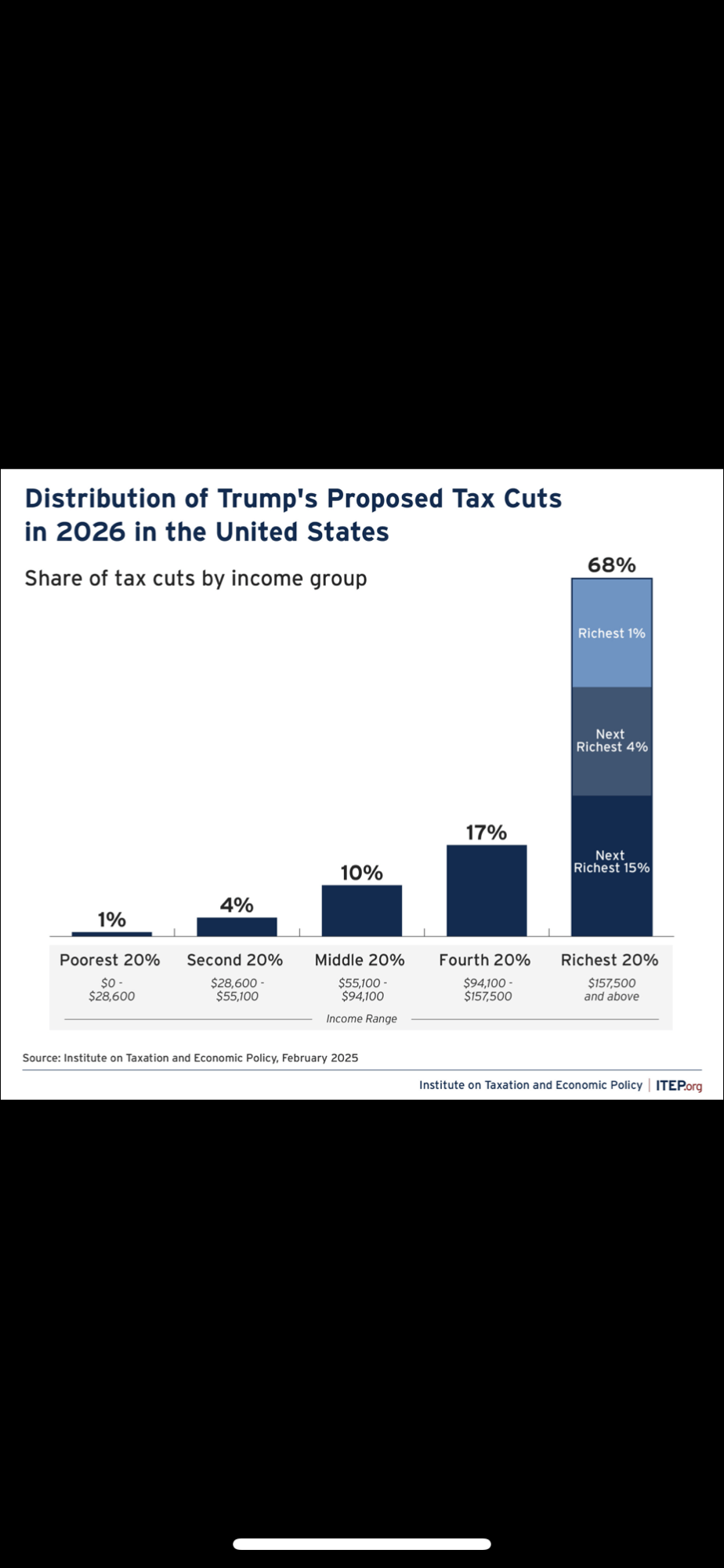

The real issue is not the government’s budget, but the structural inequality in how wealth is distributed in this country. The wealthiest Americans and large corporations continue to benefit from tax loopholes and avoidance strategies, while the rest of the population faces the burden. If the government needs more revenue, the solution isn’t cutting programs like Medicare and Medicaid—it’s requiring the wealthy and corporations to pay their fair share.

Instead of slashing these critical programs, lawmakers should focus on reforming the tax code to ensure that the wealthy contribute more. This would bring in more revenue without cutting vital services for those who need them most. There’s no need for drastic cuts if those with the greatest means are held accountable for the wealth they extract from society.

Supporters of cuts to Medicare and Medicaid argue that these programs are unsustainable due to rising healthcare costs and an aging population. But the real drain on the economy is the concentration of wealth at the top. Taxing the wealthiest individuals and corporations, who benefit from the system without paying their fair share, would alleviate much of the financial pressure.

Reforms to Medicare and Medicaid could also help reduce waste and inefficiency, such as negotiating lower drug prices. But these reforms alone won’t solve the budget shortfall. The government should prioritize investing in the services people rely on, rather than focusing on balancing a budget that doesn’t need to be balanced in the same way a business does.

What lawmakers really need is the courage to challenge the status quo—specifically, the unjust tax policies that favor the wealthy. A fair tax system would address the real drivers of the budget deficit and allow the government to continue providing vital services, like Medicare and Medicaid, without cuts.

The CBO’s estimate shouldn’t be seen as a call for more cuts to essential programs. It’s a signal that the government’s revenue system is broken, and the real solution is taxing the wealthy and corporations. The government should not be forced to operate like a business—it must focus on what it was designed to do: provide services and meet the needs of its people.

Instead of pushing for a balanced budget, lawmakers should prioritize policies that ensure the wealthy and corporations contribute their fair share, protect vital programs like Medicare and Medicaid, and focus on long-term investments in the well-being of the country.