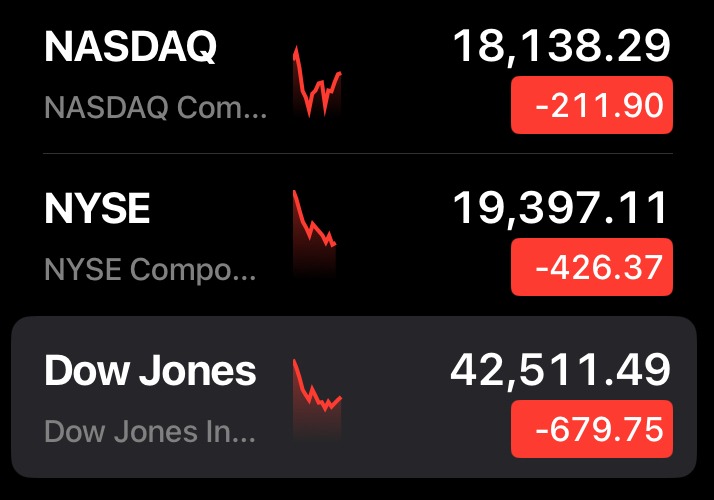

The stock market can be a rollercoaster, especially during times of economic uncertainty like the so-called “Trump Market Crash.” However, as investors, we must remember one key principle: don’t let fear drive your decisions.

Warren Buffett, one of the most successful investors of all time, offers timeless advice: “When others are afraid, be bold. When others are bold, be afraid.” In times of market downturns, fear often dominates, leading many investors to sell off their stocks at a loss. But, if you can ride out the storm and avoid selling, you’re positioning yourself for the eventual recovery.

Rather than panicking and liquidating your investments, consider holding onto them. If you’re able to invest more, use this opportunity to buy stocks at a lower price, reducing your cost average. When the market recovers, and it eventually will, you’ll not only recoup your losses faster, but you’ll also stand to make more in the long run.

Remember, short-term volatility can be unsettling, but long-term success comes from staying the course. In challenging times, patience and boldness in the face of fear are the strategies that often lead to the greatest rewards.