In just seven weeks, President Trump’s policies have derailed what was a strong economy, pushing the country toward a potential recession. A mix of reckless trade moves, unsustainable tax cuts, and erratic policymaking is driving economic instability.

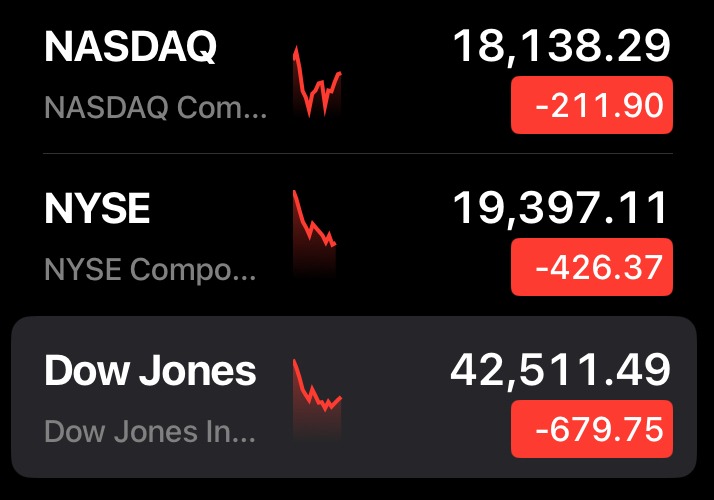

Trump has slapped heavy tariffs on key trading partners like Canada, Mexico, and China, disrupting supply chains and increasing costs for American businesses. These tariffs—meant to protect domestic industries—are instead forcing companies to raise prices, cut jobs, and delay investments. The stock market has also taken a hit as uncertainty grows.

The administration’s tax policies are making the national debt explode. Trump has pushed for more tax cuts without reducing spending, creating a fiscal mess that could add over $4 trillion to the deficit in the next decade. This puts upward pressure on inflation and interest rates, threatening long-term economic stability.

Businesses need stability to plan for the future, but Trump’s unpredictable policy shifts are making that impossible. One day he’s raising tariffs, the next he’s rolling out unclear tax exemptions. This uncertainty has led to reduced hiring and investment, further slowing economic growth.

Economic indicators point to trouble ahead. Inflation is rising due to tariffs, consumer confidence is slipping, and businesses are scaling back. Credit card delinquencies are up, and financial markets are growing nervous. If this trend continues, a recession is almost inevitable.

Trump’s economic policies are proving to be reckless and costly. If he doesn’t change course, the U.S. could face another deep recession—one entirely of his own making.